Imagine that you are asked to estimate the total cost of a project. You have measured the quantities, and estimated the cost and price of each resource required for executing the scope of the project. After all the hard work that you have put into developing the cost estimate, you are asked how confident you are on the estimate? What is the probability of achieving this cost at the end of the project? Have you considered risks and uncertainties on the project?

What would be your answer?

Well, to account for cost uncertainty and to guarantee that the budget is not exceeded at a certain confidence level, a reserve fund needs to be added to your base cost estimate. This reserve amount, known as the contingency, is an estimated amount added to the project base estimate to cover the known-unknown risks in the project and to prevent cost overrun.

More details about what cost contingency is in a cost estimate can be found in this post.

But how the Cost Contingency Reserve, the cost of known-unknown risks, is estimated?

How to Calculate the Cost Contingency Amount?

There are several different ways to quantify the uncertainties and measure the contingency reserve in a cost estimate. In fact, in the past two decades, many practitioners and researchers have come up with different methods of calculating cost contingency. These methods range from simply applying a predetermined percentage of total project cost to considering complex mathematical and statistical methods.

In this post, I am not going to cover all contingency calculation methods out there. My focus is only on the most common methods for calculating contingency.

The calculation of cost contingency is either based on “deterministic methods” or “probabilistic methods”.

Deterministic Methods

In practice, the deterministic methods are the simplest and most common methods for establishing the cost contingency reserve fund. The term “deterministic” implies that the cost contingency is determined as a single point estimate, typically as a percentage of the base cost estimate.

Percentage of Project Base Cost Estimate

In deterministic methods, contingency is estimated as a predetermined percentage of base cost depending on the project phase.

Contingency= % x Base Cost Estimate

In this technique, you take a percentage of the cost of the project and calculate the contingency amount. To do so, you need to have an expert judgment or use some predetermined guidelines or both.

– Expert Judgment

In this method, an expert, or a group of experts with a strong basis in experience and competency in risk management and analysis, determine the percentage of contingency for the project.

Although the experts consider specific situation of the project and determine a unique contingency percentage for the project, they still don’t perform a formal and comprehensive risk analysis on the project. Therefore, this method cannot provide the confidence level for the adequacy of the estimated contingency.

– Predetermined Guidelines

According to the Association of Advancement for Cost Engineering, AACE International, this method may be as simple as providing a single contingency (e.g., percentage of base cost) for use on all estimates of a certain type to complex tables or scoring mechanisms that employ elements of parametric modeling.

A common approach is to establish a table of contingency values and ranges for each of AACE’s estimate classes with alternate values and ranges provided for common risks. For example, for a class 5 concept screening cost estimate, a 40% contingency may be assigned, whereas a class 2 cost estimate may include a 15% contingency.

Although calculating contingency using predetermined guidelines is simple, understandable, and consistent, it cannot effectively address the impact of risks that are unique to a specific project.

Therefore, these deterministic methods are usually used by organizations that are not interested in applying a formal risk assessment and analysis on the project for various reasons such as lack of time, insufficient funds, and the type or size of the project. The typical use of the determinist methods is on small and non-complex projects.

Probabilistic Methods

In the probabilistic methods of calculating contingency, uncertainties are modeled in the cost estimate using statistical distributions.

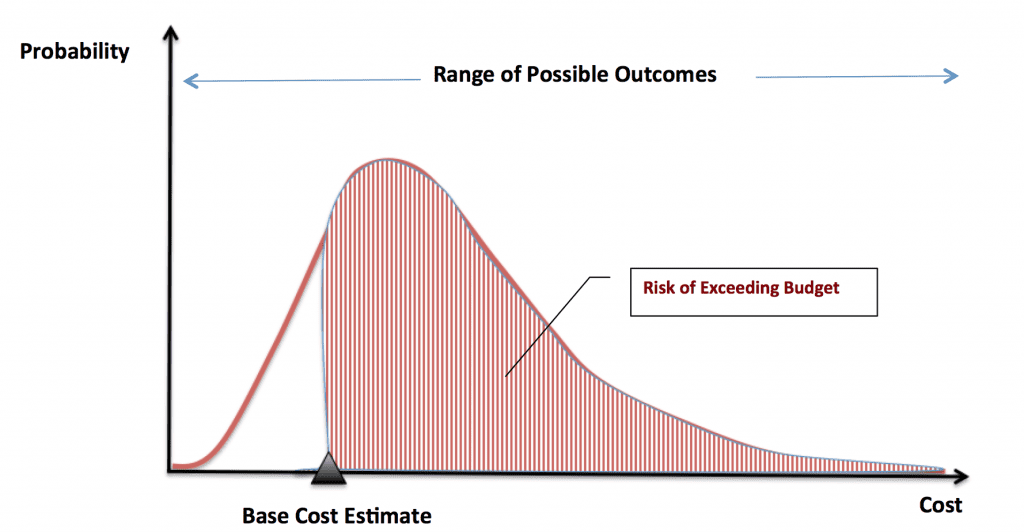

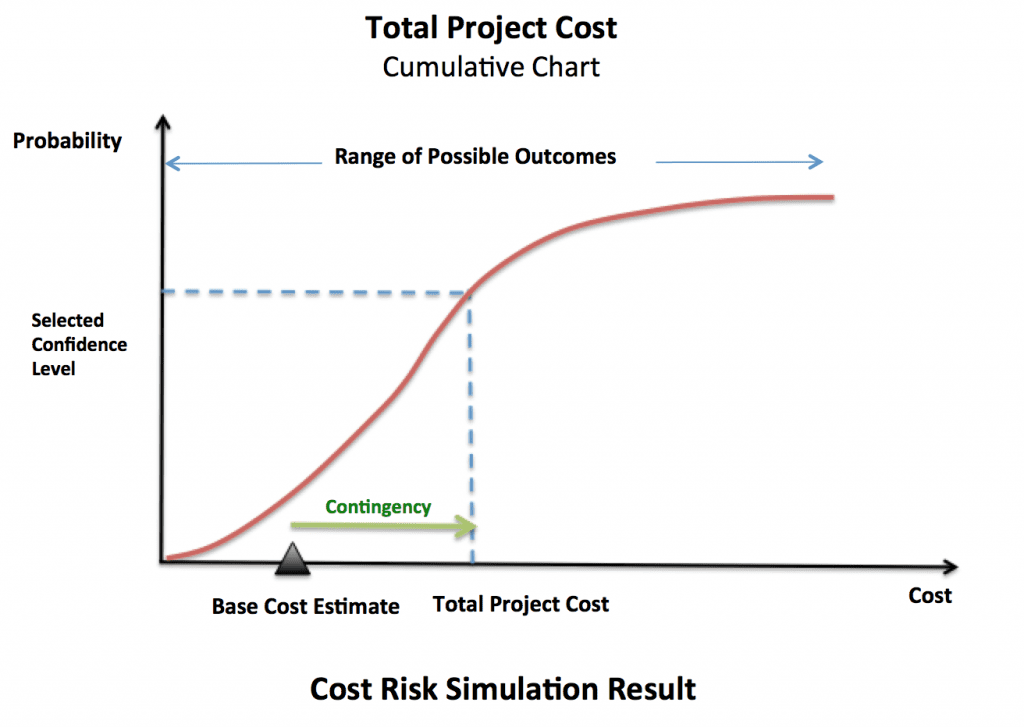

The outcome of the probabilistic methods is an estimate range distribution rather than a single point estimate, as illustrated in the graph below:

The contingency budget is determined according to the desired level of confidence that the owner would like to have on the project.

The probabilistic risk assessment methods require more time and budget to conduct, and as a result are used on large and more complex projects.

There are several probabilistic risk assessment methods that can be used for calculating the cost contingency. These methods include but not limited to:

- Probability Tree

- First-Order Second-Moment

- Analytical Hierarchy Process

- Parametric Modeling

- Expected Monetary Value

- Range Estimating

I am not going to discuss the details of each technique listed above. Instead, I’d like to discuss the most common probabilistic methods in use including “range estimating” and “expected value”; both of which may use Monte Carlo simulation or similar simulation routines.

Expected Value

Expected Monetary Value is a statistical technique that has been in use for both decision and risk management for many decades. It is used to quantify the impact of each significant identified risk, which in turn assists in the calculation of the contingency reserve.

Expected value in its most basic form can be expressed as follows:

Expected Value = Probability of Risk Occurring x Impact If It Occurs

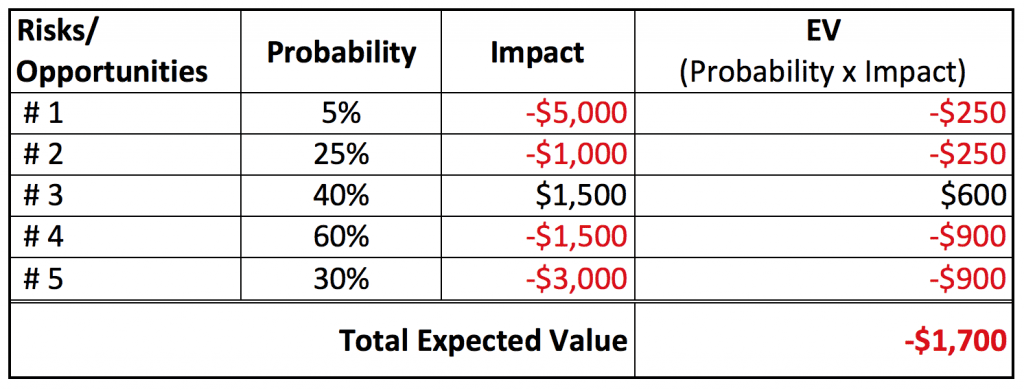

The use of the Expected Value method starts with the identification of risks. Once the risks are listed, the probability of occurrence of each risk and the cost impact, if risk happens, is estimated. Then, the Expected Value of all identified risks is calculated by multiplying each risk’s probability of happening by the resulting cost if it happens and then adding up the results.

For example, in the case above you may need to add $1,700 to your base cost estimate as a contingency to cover all identified risks.

This was a simple example of using the Expected Value method. However, instead of using a single point cost impact estimate, a range of impact costs may be assessed. In this case, the probability and cost estimates are replaced by distributions that are assigned by the team based on their understanding of the risks. Also, at that time significant correlations amongst risks and cost are incorporated into the analysis. Then a Monte Carlo or similar simulation program is run that uses these probability and cost distributions as its input. The simulation’s output is a total cost distribution along with other data designed to support the decision-making process.

More details about the contingency calculation using the Expected Value can be found in AACE’s Recommended Practice No. 44R‐08, Risk Analysis and Contingency Determination using Expected Value.

Range Estimating

On the range estimating method, instead of a single point cost estimate, a range of possible cost outcomes is estimated.

What is single-point estimating vs. range estimating?

Well, in single-point estimating, the estimator assigns a single cost value to each cost element of the estimate. However, a single point estimate for the project assumes that the project will cost this much and clearly does not take into account the uncertainties and risks affecting the project. The single point tends to be the most likely cost in the estimator’s view; the probability of achieving this cost is not fully evaluated.

However, the range estimating method assigns a range of possible cost outcomes to cost elements and evaluates the probability of achieving the overall cost estimate.

In the range estimating method, it is important to mention that you don’t need to assess every single cost element in the cost estimate and assign a range. Instead, you need to identify the cost elements that can have a critical effect on the project outcome and apply ranges only to those critical items.

Simplistic approaches may apply ranges to a summary of estimated costs at some level of detail such as the project’s work breakdown or cost account structure.

Each cost element identified in the model is assessed with a range of minimum, maximum, and most likely values that are assigned by the team based on their understanding of the risks.

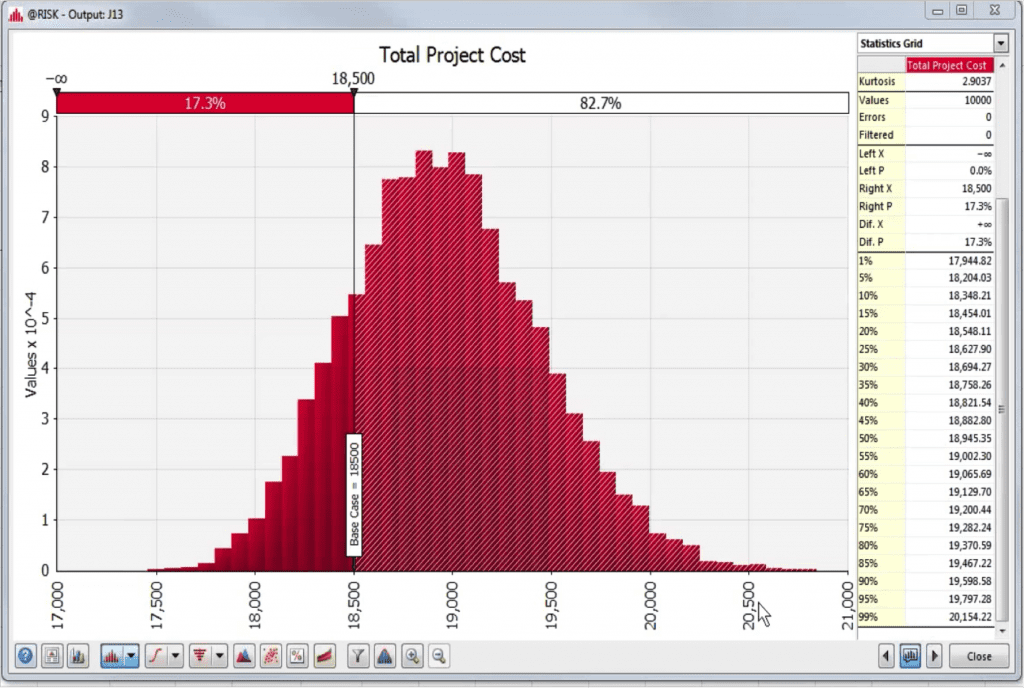

Also, significant correlations amongst cost elements are incorporated into the analysis. Then a Monte Carlo or similar simulation program is run that allows the cost to vary between the maximum and minimum values randomly. This results in a total project cost estimate distribution as shown in the diagram below:

In this example, the probability of meeting the base cost estimate is only 17%, which is quite low.

From this distribution, a cost value can be selected that has the desired probability of having a cost under-run or cost overrun.

A good estimate from a developer’s perspective should have equal probability of overrun and under-run (i.e., a 50% probability). This is a risk neutral approach, the assumption being that some projects will overrun while others will under-run and, in the long run, they will balance out.

In the example above, for a P50 confidence, the budget should be $18,945, which gives you a $445 (=$18,945-$18,500) in contingency reserve fund. This information can also be obtained on the graph by drawing the cumulative probability curve, which is not shown here.

The more conservative, risk-averse attitude is to have a higher confidence (e.g probability of 80% or higher) that the project will not overrun. This is a safer route but by specifying a high probability the required contingency as well as the overall project cost will increase.

In the example above, for a P90 confidence, the budget should be $19,598, which gives you a $1,098 (=$18,598-$18,500) in contingency reserve fund.

Did you notice how contingency was calculated?

The difference between the cost estimate without contingency, and the cost with selected confidence level from the cumulative distribution is “contingency”, as outlined in the graph below:

More details about the contingency calculation using the Range Estimating can be found in AACE® International Recommended Practice No. 41R‐08, Risk Analysis And Contingency Determination Using Range Estimating.

In Summary:

Contingency reserve is added to a base cost estimate to cover the monetary impacts of project risks or uncertainties. Contingency is established for each project based on acceptable risk, the degree of uncertainty, and the desired level of confidence for meeting the project budget. To keep the project within budget, the allocation of adequate contingency is necessary.

There are numerous methods for calculating contingency. Some of the most common methods discussed here were deterministic methods, as a percentage of the base cost estimate, and probabilistic methods such as Expected Value and Range Estimating.

The selection of the right method of contingency calculation for a specific project depends on many factors such as the project’s size, complexity, criticality, and the level of uncertainty. Other factors such as time, money, and available expertise also plays an important role in selection of the method for contingency calculation.

Please share your experience in contingency calculation. What method(s) have you used and which ones do you recommend? Please post your comments down below.

About the Author, Shohreh Ghorbani

Shohreh is a licensed project management professional (PMP) recognized by Project Management Institute (PMI) and holds a Master of Science in Industrial Engineering.

Connect with Shohreh via Facebook, LinkedIn, Instagram, YouTube

![[Free 90-min Masterclass] The Ultimate Leadership Recipe for Project Professionals](https://www.projectcontrolacademy.com/wp-content/uploads/2024/08/4-1024x576.jpg)